After extensive research into nonprofit hospitals in Louisiana, Arkansas, and Texas, the Nonprofit Accountability Project has released our findings and recommendations in a paper, “Charity for Whom?“

On September 24, we went to hospitals in New Orleans (Ochsner), Little Rock (St. Vincent), and Houston (Methodist) to call attention to the lack of charity care given by these, and many other, large institutions in our communities.

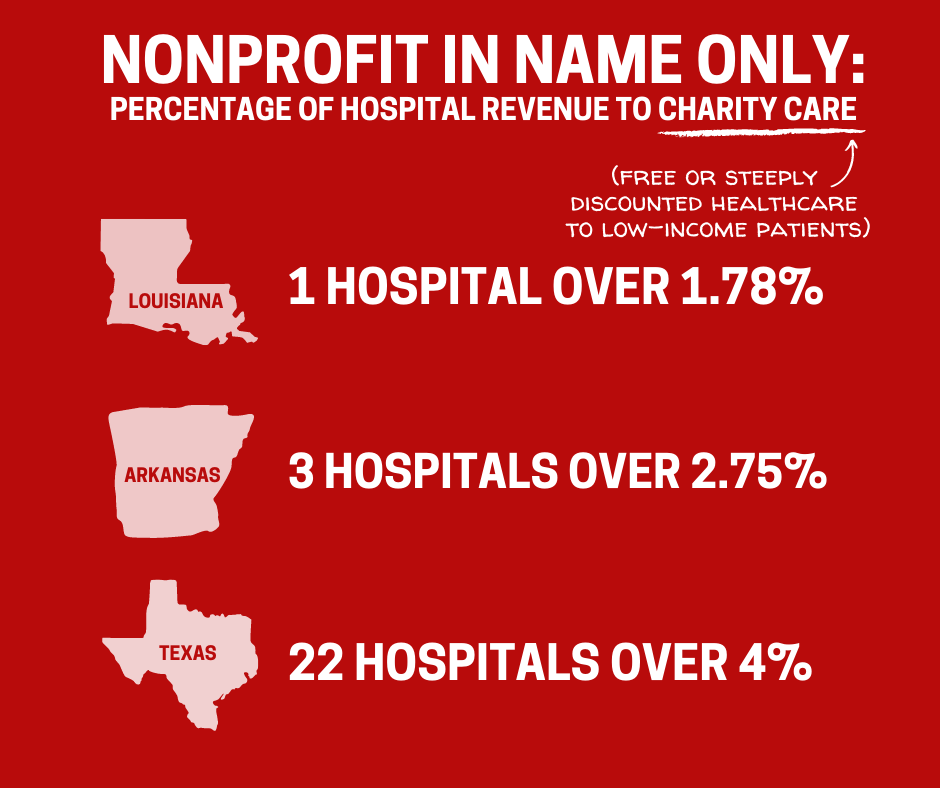

Our research indicates that the non-profit tax exemption system enables hospitals to be non-profit in name only, thereby reaping the benefits of tax exemption without sharing these gains with low income families. We argue this is due to the vagueness of relevant laws and leniency of the IRS.

This paper is the product of cooperation between Local 100 United Labor Unions, the Labor Neighbor Research & Training Center (LNRTC), and ACORN International, plus our tireless team of volunteers.

View the full data set used for the report below: