Your cart is currently empty!

Category: ACORN Canada

-

Supporting Tenants of Wiseview Montreal

ACORN Quebec was there! In front of the media to defend the tenants of Jean Brillon street tenants against their outbreak problems. Cockroaches, mice, bed bugs. It’s time for this to stop! Today’s action against the company Wiseview Montreal which does nothing against its infected housing has made some noise. Support the movement.

-

Hamilton ACORN Takes on Doug Ford

Yesterday Hamilton ACORN members held their Real People (NOT ACTORS!) for Rent Control rally outside of Doug Ford’s rally for a “Better Ontario”. ACORN gathered to bring attention to the PC Leader’s pro-landlord and anti-rent control track record, as well as recent comments that his party will be sticking with the status quo. The rally was lead by ACORN’s two chapter chairs Mike Wood and new leader Leslie Blackburn.

For a party that says it is for the people, ACORN knows real people want real rent control. The status quo has done nothing to stop rents from increasing at unaffordable rates.

ACORN was joined by allies including the Hamilton and District Labour Council which made up a crowd of around 50 people. The main slogan “real people – Not Actors! – want real rent control” was a hard jab at the Doug Ford campaign who infamously got caught paying actors less than minimum wage to appear at his rallies.

Press:

https://www.thespec.com/news-story/8629214-doug-ford-swings-through-hamilton/

http://www.cbc.ca/news/canada/hamilton/doug-ford-rally-1.4676940

-

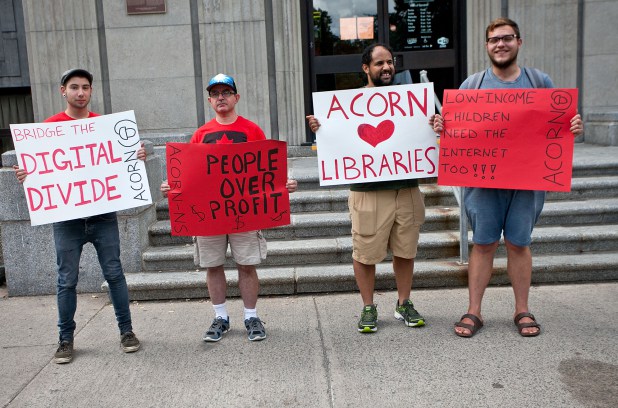

Canada’s Digital Divide Campaign Gains Lots of Press- Way to Go ACORN Canada

Protesters rally for low-income families that fall victim to the ‘digital divide’

Samantha Wright Allen More from Samantha Wright Allen

Published on: August 21, 2014Last Updated: August 21, 2014 10:00 PM EDT

The group wants the federal government and the CRTC to lower broadband prices for low income families so kids can do homework at home.

A national advocacy organization wants the federal government to better regulate broadband to give cheaper access to Internet for low income families.

Leeann Gates — a member of ACORN, the organization that coordinated Thursday afternoon’s rally to close what they say is a “digital divide” in society — says that, for years she went without Internet service, but buckled a few years back so that her daughter, now in Grade 9, could use the web for schoolwork.

But in the summer, they go without service.

“It’s important … A lot of teachers do homework through the Internet,” said Gates at the downtown Ottawa Public Library brand where about 25 protesters formed a mock library lineup, then marched to Parliament Hill.

Gates says her daughter has a learning disability and online resources can help with comprehension.

“I’m paying money that I don’t have,” said Gates, who estimates she pays about $50 a month for Internet. Lowering that would leave more for expenses like hydro or basic items for her family. “I could stop saying ‘Hey, don’t eat so much bread or milk this week.’”

The rally was part of a series of Canada-wide “back-to-school actions” by members of ACORN, the Association of Community Organizations for Reform Now. The protests demanded more affordable Internet, arguing their children shouldn’t have rely on libraries to complete homework.

According to the organization about 18 per cent of Canadians don’t have broadband, but that number jumps to nearly half for low income earners.

None of the $132 million allocated by the CRTC in 2012 to ensure Canadians connect to a “world-class communications system” specifically helped poor Canadians access home broadband, the organization contents.

Robert Fitzpatrick said Internet access is a necessity.

“As someone who’s on disability for being vision impaired as well as a permanent resident working to become a citizen, I need to stay connected (with immigration websites) so I can keep on top of my paperwork,” said Fitzpatrick, 26, who has been in Canada for just over two years and is 95-per-cent blind.

He pays about $75 a month with a roommate, and says a lower rate would mean “extra food or more clothing.”

Kathleen Fortin, who is in a wheelchair, echoed those sentiments.

The Ottawa resident said that web access is important for communication, health reasons, but also for practical purposes like job applications.

“It becomes a society of have and have-nots.”

Published on Sun Aug 17 2014

A lot of time, study, and money has been spent making sure lower-income kids receive a good education.

But a new barrier threatens to divide the haves from the have-nots at school — and later on in their careers.

It’s a lack of access to home computers and affordable, fast connections to the Internet. In 2012, almost 98 per cent of the top income households were connected to the Internet, compared to only 58 per cent of those earning less than $30,000.

A home computer and Internet connection may sound like a luxury, but study after study shows it’s a necessity to help kids from lower-income families keep up at school.

Pew Research, a leading U.S. think-tank, found that 56 per cent of teachers face a “major challenge” incorporating more digital tools into their teaching, because of low-income kids’ lack of access. And 84 per cent of teachers agree digital technologies are leading to greater disparities between affluent and disadvantaged schools and school districts.

A London School of Economics study found providing home Internet access to low income households closes the gap in use, “potentially reducing disadvantage.” It also found kids who have Internet access at home spend more time online, providing them with “higher levels of online skills and self-efficacy.”

Interestingly, home computers may also keep kids out of trouble. A PCs for People study found kids who can connect to the Internet at home were 6 to 8 per cent more likely to graduate from high school than those who couldn’t. Why? Simply by giving them something constructive to do that engages their interest. It’s a source of entertainment, as well as an educational opportunity.

All of this is why ACORN Canada (the Association of Community Organizations for Reform Now), which represents low- and moderate-income families, is holding back-to-school “actions” across the country this coming week.

Plans include setting up fake Internet cafés outside Bell Canada offices in Toronto and forming a line-up from the Ottawa Public Library to Parliament Hill with three goals in mind. The first is to highlight the problem. The second is to ask the Canadian Radio-television and Telecommunications Commission to invest in breaking down the digital divide for low income kids (as they recently did for rural Canadians). The pressure broadband providers to create $10-a-month Internet connection packages for all low-income families. It’s not a pipedream.

Rogers Communications, to its credit, rolled out a $10 connection program in 2013 for 58,000 low-income families living in Toronto Community Housing.

Educators are stepping in, too. Peel District School Board, for example, partnered with computer companies to provide low-cost tablets and refurbished computers to low-income families and now is reaching out to Internet providers “to level the playing field,” says Carla Pereira, acting manager of communications.

That’s because teachers recognize libraries can’t fill the gap.

Ashley Morris, a single mum of a 7-year-old Owen and 2-year-old Charlotte, proves the point. When Owen has homework to do, she lugs both kids to the library through a “not great neighbourhood” at night. Even then, Owen may have to line up to use the computer and it doesn’t give him time for other creative activities.

Using computers is not just about doing homework, but about “a growing experience with using technology and supporting learning in other ways,” says Heather Mathis, the acting director of Toronto’s branch libraries.

ACORN’s protests should prompt Canada’s major Internet connectors — companies such as Rogers, Bell, Telus, and TekSavvy — to work out programs for low-income families to narrow the digital divide.

It’s not just an investment in young people, but one in Canada’s future economic competitiveness. Let’s get our kids connected. All of them.

Fighting for the right to log on: Halifax protesters want $10 internet for low-income families

Darryl King is hoping internet companies will help level the playing field for low-income kids trying to get an education in today’s web-centric world.

On Thursday afternoon, King and other members of the local ACORN chapter (Association of Community Organizations for Reform Now) brought signs to the lawn of the Spring Garden Memorial Library in downtown Halifax to call attention to the “digital divide.”

King said families and individuals that fall below $30,000 a year often don’t have enough money to pay for high-speed internet and a computer they can use at home.

Related:

I just called to say, ‘use 10 digits:’ Starting Saturday, it’s 902 for all local calls

Parking ticket? No more pay-by-phone automated system as of July 1, HRM announces

Holy crap, Halifax: The scoop on spring cleanup in our city isn’t a very rosy one

“At libraries the ones that are there are booked and leaves them at a disadvantage,” King said. “They’re our next generation, we need them to succeed. How do they succeed if they don’t have the resources or the tools to make a difference?”

ACORN is calling on companies like Bell Aliant to offer a $10 per month web service and subsidized computers or tablets, and King is hoping they choose people over profit.

“What is more important, your bottom line or people who have the right to pursue an education … to contribute to society, eventually find employment through the computers, get off assistance and get back in the community?

King said they have contacted Bell so far, but have yet to hear anything back.

Prime Minister Stephen Harper has committed to getting high-speed internet in rural communities, but King said another priority should be helping low-income families in urban areas connect to the web.

“It’s not the same as it was 37 years ago, everything is … technology based,” King said. “It’s important to get out there and have that access like everybody else. The same playing field.”

-

Herongate Tenants Win Battle for Repairs

Ottawa ACORN wins long fight to get repairs in the Herongate area. See full article.

-

ACORN Canada 2012 Board Meeting and Annual General Meeting

At the ACORN Canada 2012 Board Meeting and Annual General Meeting for ACORN Canada held over the weekend, the entire ACORN Canada board and all cities came together to report on the past year and make new plans.

ACORN Canada Board Member Ginelise Edouard from Ottawa, ACORN International President & ACORN Canada President Kay Bisnath from Toronto, and ACORN Canada Head Organizer Judy Duncan (seated from left to right).

ACORN Canada Board Member Evan Coole from Cape Breton, ACORN Canada Board Member Dave Tate from New Westminster, and Sharon Shireve from Greater Toronto (seated from left to right).

ACORN Canada Board Member Ginelise Edouard reports on work in Ottawa.

ACORN Canada Board Member Evan Coole reports on work in Cape Breton, sitting between ACORN Board Member Marva Burnett from Toronto and ACORN Canada Board Member Dave Tate from New Westminster.

ACORN Canada Communications Coordinator James Wardlaw discusses communications strategies while sitting next to ACORN International President and ACORN Canada President Kay Bisnath.

ACORN Canada Board Members (standing from left to right) Peter Gardner from Surrey, Evan Coole Cape Breton, Dave Tate from New Westminster, Ginelise Edouard from Ottawa, Marva Burnett from Toronto, Rohan Jagroo from Toronto, and Pascal Apuwa from Calgary. ACORN Canada Board Members (sitting from left to right) Preeti Misra from Vancouver, Winifred Fleson from Toronto, Sharon Shireve Greater Toronto, Eddy Lantz from Toronto, and Kay Bisnath from Toronto.

ACORN Board Member Marva Burnett.

ACORN Canada Board Member Sharon Shireve from Greater Toronto.

ACORN Canada Board Member Winifred Fleson from Toronto.

-

Support Cap on Remittance Fees Now

MPP Jagmeet Singh Asks Question on Remittance Fees to the Minister of Consumer Services in Ontario, Canada.

-

Editorials in Favor of Passing a 5% Cap on Cost of Remittances

A Costly Money Migration from Ottawa Citizen

The Ottawa Citizen May 31, 2012

On Thursday, NDP MPP Jagmeet Singh introduced a private member’s bill in the Ontario legislature that deserves careful consideration from all parties. It would ensure that people in Canada won’t pay prohibitive fees to send small amounts of money overseas.

In general, the NDP instinct to solve the world’s problems by telling private businesses what they can and can’t do should be discouraged. But in this case, there’s a compelling argument for regulation.

International money transfers — also called remittances — are a bulwark against poverty. The World Bank estimates that $483 billion in remittances flowed in 2011, of which $351 billion went to developing countries. This is money that goes directly to people, bypassing governments. It’s more money than flows through foreign aid, it’s voluntary rather than taxed, and it’s resilient to political and economic cycles.

As migration plays an ever greater part in the labour market, there is great potential for remittances to improve the lots of families all over the world.

But there’s a big inefficiency in the system: fees and exchange-rate costs. According to a database maintained by the World Bank, if you’re in Canada and want to send $200 to family in Rwanda via Western Union, you’ll pay a fee of $16 and lose about 1.5 per cent on the exchange-rate margin, for a total cost of about $19.

The World Bank says the average cost of remittances in Canada is slightly more than 10 per cent, higher than both the global and G8 averages. Singh’s bill would cap fees at five per cent. The cost now varies by company, method of transfer and recipient country, and it’s worth noting that many fees are below five per cent already. But some aren’t.

The best way to drive costs down is to encourage competition. For some recipient countries, new players and technologies have led to better prices. For others, there’s an oligopoly and high prices. It seems unlikely that the most punitive fees will come down without regulation.

In 2009, the G8 vowed to bring global costs for remittances down to five per cent by 2014. Market-based approaches, such as greater transparency in fee structures, are crucial to this effort. But they haven’t brought fees down very far.

There could be unforeseen consequences to a cap on fees. The most reliable transfer companies could get out of the business for some corridors. Or they could try to make up costs by raising some fees that are currently under five per cent.

Legislators should consider these risks before passing the bill, but a cap of five per cent seems unlikely to have widespread dire consequences. We regulate other financial fees and interest rates. Remittance fees are particularly damaging because these tend to be small, frequent payments, destined for people who need every cent.

Ottawa Citizen

© Copyright (c) The Ottawa CitizenAll Ontario Parties Should Support Cap on Remittance Payments from Toronto Star

Members of Ontario’s legislature have a chance to take a small but important step toward preventing some of the most vulnerable workers in the province from being ripped off. They should seize the opportunity.

Members of Ontario’s legislature have a chance to take a small but important step toward preventing some of the most vulnerable workers in the province from being ripped off. They should seize the opportunity.It comes in a private member’s bill introduced last week by Jagmeet Singh, the New Democrat MPP for Bramalea-Gore-Malton. Singh’s bill would limit the fees charged to migrant workers and immigrants who send money back to extended family in their home countries. All parties should get on-board with this measure.

Remittances, as they’re known, involve the transfer of hundreds of billions of dollars every year around the world. The World Bank says remittance payments amounted to $501 billion U.S. last year; $372 billion of that went to developing countries.

This is far more than all the official foreign aid ($133 billion last year, as calculated by the Organization for Economic Co-operation and Development), and amounts to a big chunk of the national income of some poor countries. Even more important, it goes directly to people — not through government officials who may skim off a share or manipulate it for political reasons.

There’s a big catch, however, for many of the hard-working migrant workers and immigrants who wire money home. Fees can be hefty, to say the least. A recent survey by ACORN, a national advocacy group that is campaigning on the issue, shows it can cost as much as $40 to transfer $100 abroad, depending on the destination and speed of service. The average cost of remittance services in Canada is just over 10 per cent of the amount transferred, according to the World Bank.

Singh’s bill would cap remittance fees in Ontario at 5 per cent, and require companies like Western Union and MoneyGram to disclose any other costs or exchange fees. The 5 per cent figure is the same as that recommended by the World Bank and by the G8 group of countries, which in 2009 pledged to bring remittance costs worldwide down to that level by 2014.

No other province caps remittance fees, but the idea is no different in principle from limiting the interest charged on payday loans to prevent low-income earners from being gouged. Ontario did that in 2008.

All parties at Queen’s Park should back Singh’s bill. It would be an excellent step toward helping out some of the hardest working and most deserving people among us.

http://www.thestar.com/opinion/editorials/article/1204701–all-ontario-parties-should-support-cap-on-remittance-payments